Envision the Future is a customer experience that educates the customers how short term money management can impact their long term financial goals.

STAKEHOLDERS

PBank

PBank's customers

Carnegie Mellon University

TEAM

Allison Huang

Natalie Harmon

Christie Chong (me)

RESPONSIBILITIES

Designing educational touchpoints in customer journey

Rapid prototyping

PBank, a regional bank, approached our team to help them educate their mass affluent customers about the importance of their relevant dependencies and what action they can take for better financial decision-making. We designed a three part experience to bridge the gap between short-term management and long-term planning by raising customer's awareness to financial opportunities around them.

Envision the Future

Envision the Future is a customer experience with three major user education touchpoints. In these three areas, we address why long-term financial planning is important, how customers can start taking action, and what are other financial opportunities beyond what they originally know.

Through our experience we hoped to educate our customers on these three key concepts:

Assumptions we have made about the PBank customers in order to narrow the scope of our experience:

- Target audience doesn’t see their entire financial picture

- Have some long-term goals in mind; may be unclear and/or not fleshed out

- Are already doing things for short-term financial management

- People are willing to take low-stakes actions but maybe not more high-risk ones yet

- People want to take real steps but are hesitant

What we aim to teach PBank customers as a means of helping them realize their goals?

- Milestones to achieving long-term goals: how smaller goals can make up bigger goals

- What a standard timeline is

- Confidence: help them achieve smaller goals that lead to bigger achievements; encourage/affirm based on what they’re already doing/what they’ve already done

- What financial opportunities are out there

- Dependencies: show how long-term investments affect the short-term and vice versa

SYSTEMS BREAKDOWN

1. Virtual Reality Experience (Explore here)

We first Immerse customers in a scene where financial opportunities are present in context. In this environment, customers can explore different household articles that relate to different financial goals. We hope this will help them see the importance of why they should start investing their savings into the long term goals they might have.

2. Meeting with a Financial Advisor

We understand that goals and options we can show in the VR would not be specific to every customer and because money is such a personal matter, we have the customers meet with a financial advisor right after coming out of the experience. The financial advisor is ready to break down what the customers saw in the VR and start adjusting those goals to the customer's specific needs. Meeting with a financial advisor will also help the customers understand what are the steps they need to take in order to reach those goals and encourage a personal relationship with the bank. The financial advisor will also help the customer to set up a flexible webtool that is tied to the customer's bank account so they can continue to manage their finances at home.

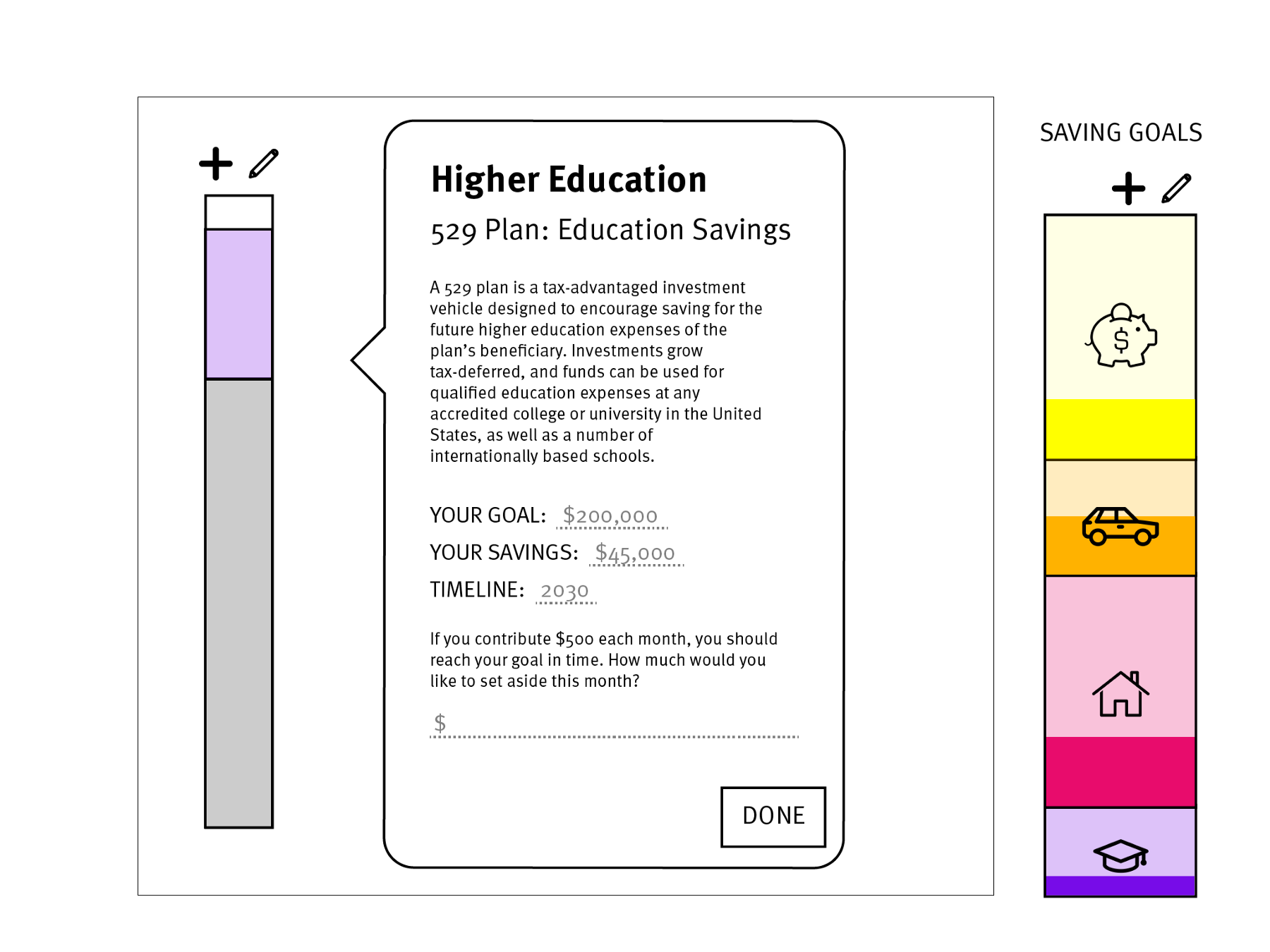

3. Flexible Framework Webtool

The webtool will give customers concrete steps in how to invest their savings in to their long term goals. Customers can adjust how much they want to invest in each goal and how quickly do they want to achieve a goal. Using those inputted numbers, the webtool will calculate the ideal amount of money customers have leftover after monthly bills and expenses that should be invested towards their chosen goals.

Application of Concept + Benefits

- Make the future tangible

- Provides context for making financial decisions

- Offers opportunity for more personalization

- Fits into a cohesive learning system as the motivating component

- Would increase in value the more the customers share information with PBank

Analysis of Prototype

Affordances:

- Appealing to customers who want more support and personalization

- VR allows for an attention grabbing multi-sensory and immersive experience

- Flexible enough to exist on the web or in other contexts

Limitations:

- Not targeted towards more experienced/pragmatic money managers or those who mistrust the bank

- May isolate customers who aren't technologically savvy

- VR is limited to physical locations and therefore has a smaller reach

Research

Working with PBank

Before designing our experience, PBank presented to our team the user research they have done prior to approaching us. Throughout our project, we had multiple check-ins, a midpoint presentation, and a final presentation at the bank. It was important for us to see both PBank and their customers as stakeholders in this project.

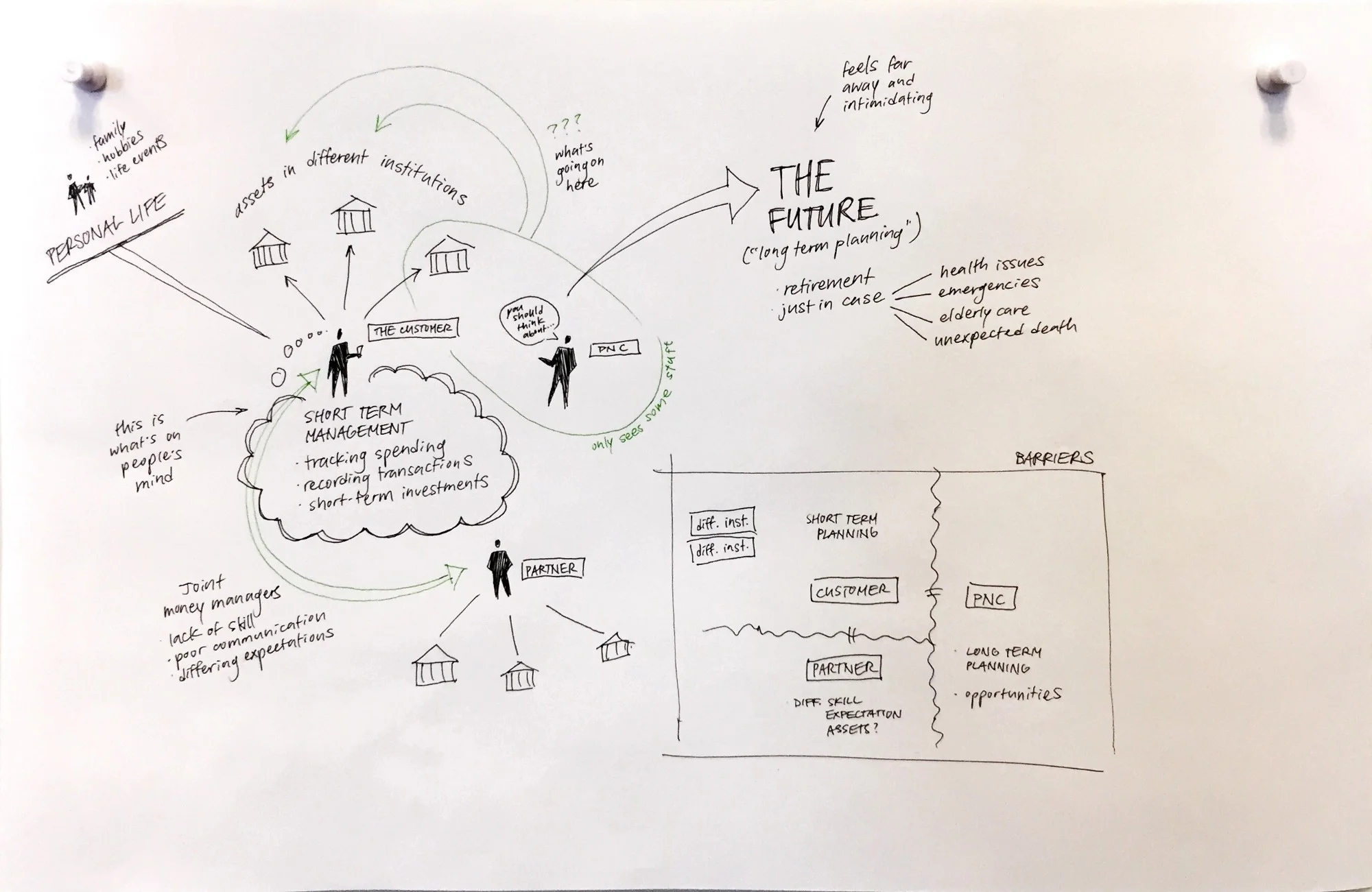

Mapping our own understanding

Money and finances is a complex problem, and especially receiving a research brief that we didn't take part of from the bank, it was necessary for us to make sure the whole team was on the same page. Seeing each other's mental models and talking through our own thought process of how to tackle this prompt brought up a lot of questions and revealed a lot of our own knowledge gaps about finances and this problem. As we were not the target audience and mostly not savvy about finances ourselves, we were a little overwhelmed with how to address such a big problem.

Questions that came up:

- How to make connections between short-term management and long-term planning?

- Do customers have assets at multiple institutions? Why do they have assets spread out?

- What are the benefits (financial offerings a bank can give) for consolidating assets in one institution?

- What does long-term planning look like?

- What does PBank currently do to reach out to their customers?

- Do customers even know about the long-term financial opportunities?

We realized we still have a lot of unanswered questions because we didn’t know our audience well enough; we decided to take a closer look at the personas.

Personas

In the research brief PBank handed to us, they have already outlined 5 different personas of mass affluent customers that they hoped our experiences would reach. The personas ranged from being accepting of any help from the bank to suspicious and wanting complete control of their assets. We went through the personas and ranked each trait, trying to qualitatively find the "average persona", but realized that designing an experience for the average persona would not fit any of the personas well. We also wanted to focus on an user experience that leaned heavily in to education so we made the decision to scope down our target customers to those that were open to the bank's help and less savvy about managing their finances.

User Education Frameworks

As we dug in to this problem about how to teach and keep customers motivated to keep learning, we looked in to a variety of frameworks that helped us breakdown the different steps our experience would need. From there, we created our own framework with important concepts that we believed our experience would have to address.

EARLY CONCEPTS

1. Dream Big! A Virtual Reality Experience

- Attend an event where PBank has a virtual reality booth

- Employees explain that this is an opportunity to build, customize, and visualize retirement life

- VR experience, questions about where you want to live (locations like beach, city, urban...)

- Employee debriefs experience and shares how much you would need to save and how to build that ideal future

- Set up meeting with financial advisor to discuss in more detail

2. Flexible Frameworks

- Web-based digital experience, introduced with an illustration of yourself at retirement age

- Answer a series of lifestyle questions and current financial situation

- Webtool will present you with a sample financial road maps to your goals

- Tailor road map to any goals by dragging and dropping various milestones into and out of framework

- Can also choose a sample road map to guide financial journey

3. Game of Life

- Workshop to compete and collaborate with other teams to see who can best invest and plan for long-term.

- Given a set of play money and different scenarios of where to put your money

- Booth where you can learn about different long-term goals and how you can invest in those goals

- Game is like a sped-up timeline of life and you can watch how your investments grow

- Short lesson/feedback about how your team did, get a chance to run through simulation again with new knowledge

Feedback on early concepts

Overall, other teams didn't see the Game of Life concept working well, but they liked the VR and Flexible Frameworks concepts.

Game of Life

- Concerned about the scalability of the event

- Disconnect between game and real life (when using fake money, doesn’t really represent the customer’s current situation

- Be mindful of different player’s current situation, might not all be at the beginnings of planning for retirement, might be discouraging

- Liked the idea of getting people to actually start talking about their money

Flexible Framework

- How is this different from other platforms online that exist already? How would it benefit PBank?

- Liked how it's grounded in reality with visuals of real life assets

VR Dream Big

- Scalability– How many VR devices, finite number of financial advisors

- Disconnect from VR experience to reality

- Would need to have a very careful storyline and selection of what questions to ask in the experience

- Good place to start the conversation for real life planning (continue the experience with an introduction to the Flexible Framework)

One big question we need to answer is how PBank will benefit from whatever it is we design. We’ve been very user-centered, which is good, but we do need to talk about how this experience will support this stakeholder's goals as well.

After reviewing the feedback we had each received, we decided to move forward with a combination of VR and Flexible Frameworks:

FINAL CONCEPT

VR + Flexible Framework

Content for each platform:

We started to flesh out what content we would want to present at each stage of our experience.

Current (In-line)

- Total annual household income

- Spouse/partner?

- Current age

- Expected retirement age

- Current stage in retirement planning

- How much do you have in retirement savings now?

- How much do you currently contribute?

VR

- Would you rather/choose your own adventure

- Home–upgrade? stay? downsize?

- Spending

- Healthcare

- Travel?

Person

- Question for PBank --> What do FAs ask?

Online (Flexible Frameworks)

- College

- Retirement

- Vacation

- Emergency funds

- House

- Car

- Starting a business

Feedback from PBank and Financial Advisor

We presented our concept during a mid-point check, and got to talk with a financial advisor to understand our target audience even more. (Although we wished we got to have this conversation earlier, it was still good!)

Walking through our customer journey with PBank

Some takeaways:

- Mass affluent range is $125,000-$999,999 of liquid financial assets–a huge range!

- People don’t know when they have “enough” to be worth the financial services they can access

- Don’t understand financial plans in depth, but don’t want to be made to feel stupid

- $500,000 tends to be the threshold when people seek out financial advice

- There’s a big range of financial educational levels that customers come in with

- Different motivators for seeking out financial advice: carrot or stick? Some people start relationships with FAs because they made a mistake (reactive). Others are more proactive and/or are afraid of making a mistake.

- This FA typically touches base with clients once a year, but other FAs have different roles

- FA uses a webtool called E-Money that provides simulations and scenarios in response to “what if” questions, but is only FA-facing

Focusing on the onboarding experience

Because of time-constraints, we decided to focus on the VR experience as we saw the onboarding stage to be the most crucial step in our three part system as it leads to the other two stages.

Some questions we asked to help us scope our experience:

- How do get people to initially engage in the learning experience (on-boarding sequence)?

- How do you get people to interact with/provide information (ex. timelines, feedback loops…)?

- How do you help people sustained engagement over an extended period of time (slow build)?

Early VR storyline:

VR Experience Storyboard

- We had an idea that an "egg" represents your pool of money that you can distribute according to the choices you make in VR.

- Introduced to the egg

- See bubbles–choices of investments, like family, education, traveling ,etc.

- Family bubble: Kitchen scene with family sounds–clinking dishes, laughter, etc.

- Answer questions about how much you would want to invest in, say, education

- Part of your egg will be placed in location of the education artifact (to show dependencies)

- End scene: zoom out to see the big picture and how things are related

Keeping it concrete

We realized that we were shying away from creating concrete and more realistic examples in our VR scene to accommodate the varying differences someone's family life might look like. But because the VR experience's purpose is to onboard customers to the Flexible Frameworks, answering the "Why does this matter?" question works best with concrete examples.

We decided to pinpoint the tone and start writing out our content to help us inform our visual style.

Tone

We came up with some spectrums to help us decide what our language should be like. We ended up being pretty balanced for all the spectrums, except we would want to lean more towards a polite tone than rude.

Casual-----------------------x-------------------------Formal

Emotional------------------x-------------------------Robotic

Rude----------------------------------x-----------------Polite

Concise----------------------x------------------------Drawn-out

Judging----------------------x--------------------------Spoiled

Beginning to Make

Prototyping for VR

Inspiration

Early explorations with converting a cubemap to an equirectangular projection:

Pivoting from the early VR storyline:

As we continued to write out content, it became apparent to us that our visuals need to also be more concrete. An "egg"'s form (blobs), although works nicely with a more abstract concept, is hard to quantify which is especially important when we are talking about money. We decided on using the average number of what certain investments might cost and visualize them as bars as that is also easier to compare and has closer affordances to quantity/amount.

In an early bar concept, we had each financial opportunity to be a different color (ie. Education, orange bar). But as we also continued to work on the webtool and thinking about how a customer actually organizes their finances, we realized that people don't have a separate account for each type of financial opportunity. Usually money that is distibuted to different investments come from one account so having the bars all the same color would fit customer's mental model of their finances and drive in the idea that all these financial goals might result a large sum of money.

Webtool Iterations

A big breakthrough we had with the webtool was finally understanding the relationship between monthly money management and long-term goals. What we were looking wasn't a bridge to fill the gap between those two thought processes, but helping customers see how their short-term goals AFFECTS their long-term plans.

Our webtool focuses on how customers can organize their short-term finances to help them achieve those long-term goals .

Presenting at PBank & us being super dorky with our VR sets